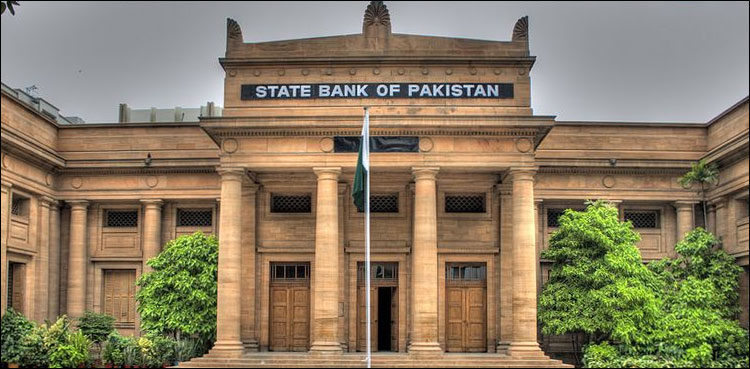

Karachi: The State Bank of Pakistan (SBP) has rectified prudential regulations to increase and encourage involvement, participation, investment of bank and establishment of financial organizations in the real estate investment trusts (REITs).

The recent statement by the central bank states that the development of the housing and construction sector, according to the government’s initiative. The State Bank of Pakistan has been making diverse steps and following best practices to amidst enhance banks/DFI engagement with their finance in the growth of these sectors.

According to the statement: “To further increase involvement and participation into these land sectors. The State Bank of Pakistan has now made provisions of certain changes, existing Prudential Regulations and Investment of Bank/DFIs in the real estate investment trust.”

Primarily, REITs are property management organizations that finances and own profit-producing real estate covering a diverse range of property sectors. These organizations make funds by raising them from the public and general institutions by levitating different types of donations. REITs deploy these funds by investing in land properties thereby enhancing the investment within the housing and construction sector to contribute to economic success and development.

There are no of benefits for investors, because of the listed units of Real Estate Investment Trust (REITs) on the Pakistan Stock Exchange.

Due to the modifications in SBP regulations, it would enhance DFIs and banks to make larger investments in real estate at the tuning rate of 15pc of their equity much higher than the previous limit of 10pc of equity. This step not only increase investors to diversify their investments but it will bring more capitals to approach towards Real Estate Investment Trust (REITs).

Added on, the State Bank of Pakistan has also eased restrictions on seeking financing against shares of listed groups in existing regulations. Therefore, it’ll enable investors in raising liquidity in future investments for new business opportunities and ventures resulting in greater economic exertion.

Lastly, it would also be beneficial for the capital market by enabling sponsors of organizations to contemplate listing on the stock exchanges. Because of this change in regulation, it will boost certification of good corporate governance practices and the economy as well.